May

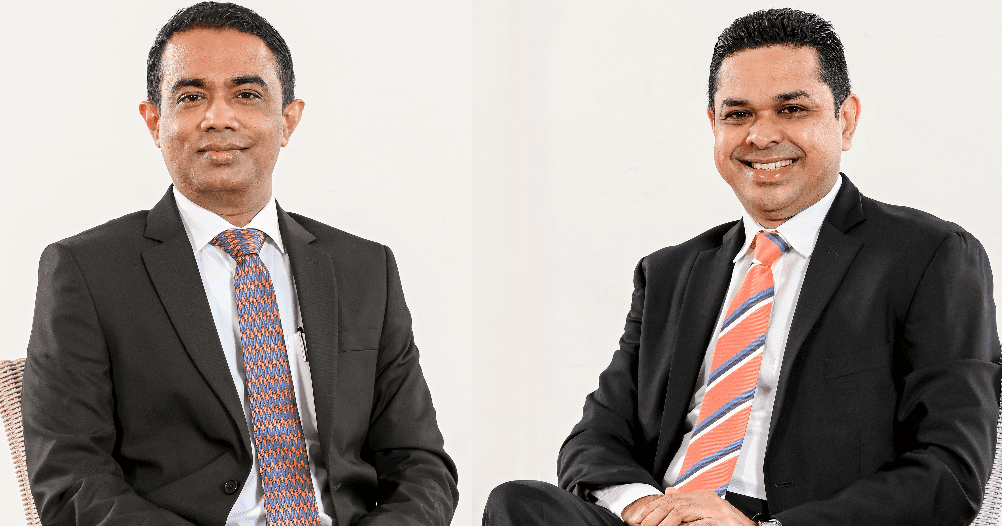

HNB Assurance PLC Group delivered a robust performance during 1Q22, recording a Profit After Tax (PAT) of LKR 235 Mn, reflecting an impressive growth of 144%, compared to the PAT of LKR 96 Mn recorded during the corresponding period of 2021. The Group recorded a Gross Written Premium (GWP) of LKR 4.3 Bn depicting a notable growth of 33%. Sharing her views on the Group’s financial performance, Chairperson of HNB Assurance PLC (HNBA) and its fully owned subsidiary, HNB General Insurance Limited (HNBGI), Mrs. Rose Cooray stated, “In spite of several macro-economic challenges prevailing in the market, HNBA and HNBGI delivered an outstanding performance during the first quarter of the year. Both HNBA and HNBGI held a firm stand in delivering these stellar results which contributed to the topline and profitability growth of the Group. These results demonstrate our customer-centric and well-curated business strategies in capturing markets with growth potential. The Life Insurance business recorded a GWP of LKR 2.3 Bn and the General Insurance business recorded a GWP of LKR 1.9 Bn, showcasing an impressive growth of 41% and 24% respectively. Other Revenue of the Group surpassed LKR 1 Bn during 1Q22 marking a 30% growth. During the period, Total Assets of the Group surpassed LKR 37 Bn and Financial Investments surpassed Rs. 30 Bn. The Investment Income of the Group for the period was LKR 938 Mn with an outstanding growth of 40% compared to corresponding period of the previous year and continued to maintain an investment portfolio with healthy credit quality. The Group remains well focused on its clear motive to explore and capture new markets by providing an innovative and a superlative customer experience while maxing shareholder returns”. Mr. Lasitha Wimalaratne, Chief Executive Officer of HNB Assurance PLC expressed his views stating, “HNBA concluded another successful quarter showcasing a steady and stable growth momentum, amidst increasing challenges in the external environment. During 1Q22 HNBA recorded a GWP of LKR 2.3 Bn, showcasing a stellar growth of 41%. During the period, the Life Insurance fund reached LKR 21.4 Bn. The Capital Adequacy Ratio (CAR) of HNBA during 1Q22 stood at 281%. This further reaffirms the Company’s financial stability as CAR is well above the minimum stipulated rate of 120% as directed by the Regulator. Owing to our promise, HNBA settled Insurance Benefits and Claims amounting to LKR 527 Mn”. Mr. Wimalaratne added, “These results are a testament to our well-focused strategies and collective efforts of all teams. Backed by an A+ (lka) rating for National Insurance Financial Strength by Fitch Ratings Lanka, the Management of HNBA remains confident of its competitive advantage and strong financial footing and is focused on what’s ahead and seizing every opportunity to expand its footprint in the market”. Expressing his views, Chief Executive Officer of HNBGI, Mr. Sithumina Jayasundara stated, “During a challenging period for the entire insurance industry, HNBGI was able to deliver steady financial results capitalizing on its service and operational excellence. Surpassing the industry growth rates, HNBGI recorded a GWP of LKR 1.9 Bn showcasing an impressive growth of 24% during 1Q22. The Company continued to deploy its agile business strategies despite the on-going economic challenges and was able to seize several growth opportunities. The Miscellaneous and Motor Insurance segments delivered a notable performance followed by Fire and Engineering segments. During the period, the Company settled Insurance Benefits and Claims amounting to over LKR 830 Mn showcasing our steady commitment to our customers. Demonstrating the Company’s strong financial footing, the Capital Adequacy Ratio (CAR) of HNBGI stood at 247%, well above the regulatory requirement. The General Insurance Contract Liabilities surpassed LKR 4.2 Bn.” Mr. Jayasundara further stated, “As one of the two Fitch Rated General Insurers in the country with an A+ (lka) rating for ‘National Insurer Financial Strength’, HNBGI will continue to steer its course through many challenges to further consolidate its footprint in the market whilst sustaining our core business model and delivering value to all stakeholders”. HNB Assurance PLC (HNBA) is one of the fastest growing Insurance Companies in Sri Lanka with a network of 64 branches. HNBA is a Life Insurance company with a rating of ‘A+’ (lka) by Fitch Ratings Lanka for 'National Insurer Financial Strength Rating'. Following the introduction of the segregation rules by the Insurance Regulator, HNB General Insurance Limited (HNBGI) was created and commenced its operations in January 2015; HNBGI continues to specialize in motor, non-motor and Takaful insurance solutions and is a fully owned subsidiary of HNB Assurance PLC. HNB General Insurance has been assigned a 'National Insurer Financial Strength Rating' of ‘A+’ (lka) by Fitch Ratings Lanka Limited. HNBA and HNBGI are rated within the Top 100 brands and Top 100 companies in Sri Lanka by LMD and HNB Assurance has won international awards for Brand Excellence, Digital Marketing and HR Excellence including the Great Place To Work® Certification. HNB Assurance was awarded the Best Bancassurance Service Provider in Sri Lanka by Global Banking and Finance Review and has won many awards for its Annual Reports at award ceremonies organized by the Institute of Chartered Accountants of Sri Lanka.

Mar

HNB Assurance PLC (HNBA) and HNB General Insurance Limited (HNBGI) recently held a series of forums focused on all employees with the aim of discussing the topic of biases and barriers and to further the agenda of equity within and outside organizational boundaries. This program featured sessions by Ms. Chiranthi Cooray, General Manager/Chief Transformation Officer of Hatton National Bank PLC and Non-Independent/Non-Executive Director of HNB General Insurance Limited and Professor Arosha Adikaram, Chair Professor of Department of HRM at Faculty of Management and Finance, University of Colombo, who have had a long-standing commitment towards “equity at workplace” agenda. Speaking at the forum, Ms. Chiranthi Cooray expressed her views stating, “Every year, during the month of March we come together to laud, celebrate and pay tribute to the spirit of womanhood, but it should not only be limited to March. Our commitment towards gender equality, breaking the bias and creating a difference where women are valued and celebrated should be renewed every day. Gender inequality manifests in the distribution of resources, work, power or even time. We must truly accelerate our efforts to break all barriers and norms and build a sustainable future of inclusion, diversity and equity for everyone”. Sharing her views, Professor Arosha Adikaram stated, “Every woman is strong, confident, and powerful in her own way and women have achieved great milestones both personally and professionally by immensely contributing to the development of today’s society and economy. As we celebrate the strength of women, we should ensure that women are recognized for their efforts, contribution, hard work, and for balancing multiple roles in their day-to-day lives. It is even more important for everyone in the society to help women to achieve their goals and dreams. Hence, is it crucial to build a world free of all forms of bias, discrimination and stereotypes and inspire women to love themselves, take care of themselves and achieve their heart’s desire”. In demonstrating solidarity to the agenda of breaking barriers, Mr. Lasitha Wimalaratne, Chief Executive Officer of HNBA and Mr. Sithumina Jayasundara, Chief Executive Officer of HNBGI shared their views and pled their fullest commitment. Mr. Dinuka Pattikiriarachchi, Chief Human Resource Officer of HNBA and HNBGI explained the provisions provided at policy level as well as practice to protect and develop all employees. He further explained the duty and responsibility of each other to promote fairness and equity for those who have a lesser voice. In conclusion he added, “Women are not defined by the choice of clothing, lifestyle, or profession but by her strength, knowledge, resilience, confidence, and courage. Women across industries have achieved remarkable milestones and made great strides and whilst saluting all women for their strength and will power to challenge the society and make their voices heard, let’s pledge our support to promote equality, diversity and inclusion in everything that we do and say”. HNB Assurance PLC (HNBA) is one of the fastest growing Insurance Companies in Sri Lanka with a network of 63 branches. HNBA is a Life Insurance company with a rating of ‘A+’ (lka) by Fitch Ratings Lanka for 'National Insurer Financial Strength Rating'. Following the introduction of the segregation rules by the Insurance Regulator, HNB General Insurance Limited (HNBGI) was created and commenced its operations in January 2015; HNBGI continues to specialize in motor, non-motor and Takaful insurance solutions and is a fully owned subsidiary of HNB Assurance PLC. HNB General Insurance has been assigned a 'National Insurer Financial Strength Rating' of ‘A+’ (lka) by Fitch Ratings Lanka Limited. HNBA is rated within the Top 100 brands and Top 100 companies in Sri Lanka by LMD and HNB Assurance has won international awards for Brand Excellence, Digital Marketing and HR Excellence including the Great Place To Work® Certification, and won many awards for its Annual Reports at award ceremonies organized by the Institute of Chartered Accountants of Sri Lanka.

Mar

HNB General Insurance Limited (HNBGI), a trusted and leading General Insurer in the country, joined hands with the Federation of Information Technology Industry Sri Lanka (FITIS) as Premium Corporate Partner for 2022.

Sharing his views on the partnership, Chief Executive Officer of HNBGI, Mr. Sithumina Jayasundara stated, “HNBGI is thrilled to joined hands with FITIS, a non-profit organization working towards fostering and developing the ICT industry in the country. This strategic partnership augurs well for the Company’s mission in providing seamless corporate solutions for entities to explore new avenues of growth potential in their respective industries and this aligns both HNBGI and FITIS to benefit well by combining the strength and expertise of both entities. This partnership will help in yield a number of exclusive benefits, especially for IT and tech companies as HNBGI specializes in Professional Indemnity covers. HNBGI is excited to work with FITIS in future projects”.

“As the apex body for the ICT industry in Sri Lanka, FITIS is indeed honored to partner with a trusted and well-respected organization such HNB General Insurance Limited. At FITIS, we are constantly looking at ways to enhance the benefits offered to our members and looking at the impressive product portfolio offered by HNB General Insurance Limited, we are confident that this partnership will be a mutually beneficial one” said Mr. Shehan Kumar, Chief Executive Officer of FITIS".

HNB General Insurance Limited (HNBGI) was incorporated in January 2015 and specializes in Motor and Non-Motor Insurance Solutions and is presently one of the fast-growing General Insurance Companies in Sri Lanka, with a network of 56 branches. The Company is ranked within the Top 100 Brands and has been awarded a ‘National Insurer Financial Strength Rating’ of ‘’A+’’ (lka) by Fitch Ratings Lanka Limited and has obtained the Great Place to Work® Certification. The Company was awarded the Motor Insurance Initiative of the Year - Sri Lanka award at the Insurance Asia Awards 2021, and is a fully owned subsidiary of HNB Assurance PLC (HNBA).