Sep

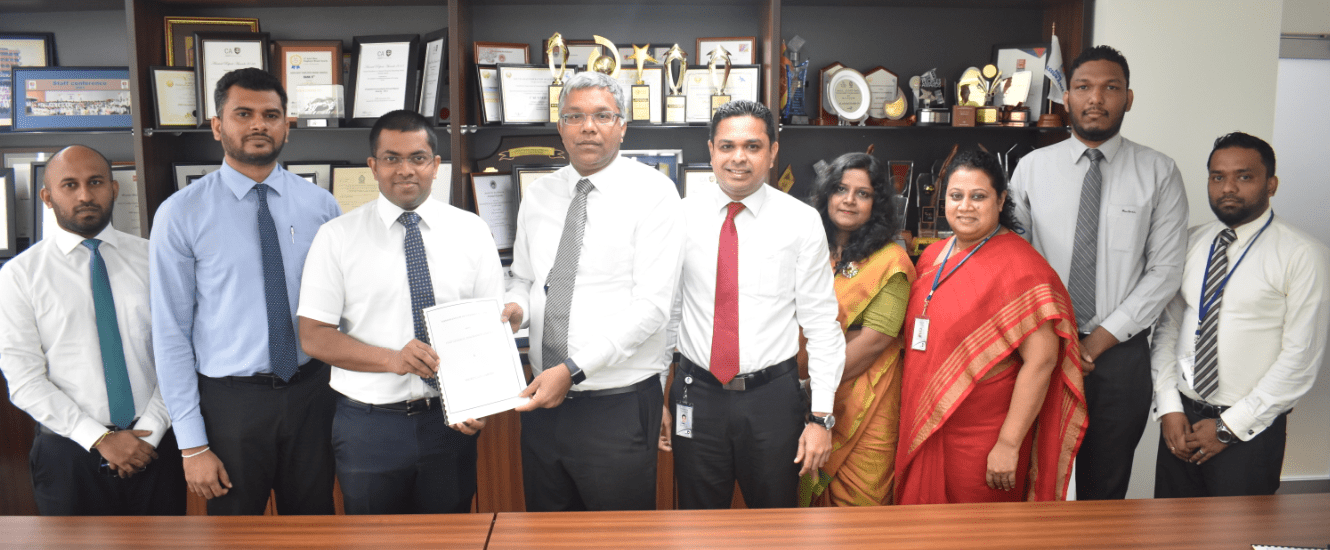

HNB General Insurance Limited (HNBGI), the fully owned subsidiary of HNB Assurance PLC (HNBA), stood together with Micro Cars (Pvt) Ltd., as it was announced that the two entities have agreed upon a Memorandum of Understanding, to promote the MG range of vehicles. This partnership is aimed at enhancing the synergies that the two companies bear in a sense of insuring vehicles, whilst matching business quality and consistency. The MOU was signed by Managing Director/CEO of HNBA and HNBGI, Mr. Deepthi Lokuarachchi and Director of Micro Cars (Pvt) Ltd. Mr. Ruvindhu Guneratne.

Sharing his views about the agreement, Mr. Lokuarachchi stated, “we have been working togerther with Mirco Cars (Pvt) Limited for some time now and over the years have been offering the motoring public of Sri Lanka the peace of mind to enjoy the pleasures of driving a MG knowing that their pride on wheels is fully covered. We are also pleased at working towards offering free insurance covers to those who own a MG from Micro Cars, who has been a mover and shaker in Sri Lanka’s automotive industry in the recent times. Our insurance solutions can be tailored to suit the discerning motorist so that adequate protection for the vehicle could be obtained. In this regard, I would like to mention our product, MotorGuard Extra for example, which allows replacement of brand new parts without an owners contribution even after the first three years. We are very pleased to sign this MOU with Micro to promote such an iconic motoring brand as MG. I am sure that this tie up whilst being mutually beneficial to both our organisations, would be of greater benefit to both our customers”.

Speaking about the partnership, Mr. Ruvindhu Guneratne shared his views stating, “it is with great pleasure that we, together with HNBGI, embark upon yet another purpose driven initiative, that is expected to spur quality service and networking within our businesses, whilst addressing need-based aspects in a customer perspective. As an entity that has stood up to the continuing development in the Sri Lankan Automobile Industry, Micro Cars (Pvt) Ltd. aims to go beyond the core product by assuring that on road safety and after sales services have met its highest standards. I am thankful for all those who have contributed in achieving this milestone in revolutionizing the automobile industry by providing our customers a comprehensive insurance of this nature.”

Sep

HNB General Insurance Limited (HNBGI), the fully owned subsidiary of HNB Assurance PLC (HNBA), took the centre stage along with Softlogic Finance, signifying the establishment of a forethought partnership aimed towards ensuring that safety is met on the note of the many motorcyclists in Sri Lanka. The tie up is set to address the rise of accidents at present particulary involving motorcyclists, triggered by the incomprehension of safety precautions and protocols. As such, this collaborative approach was officially initiated at an event partaken by officials of HNBGI and Softlogic Finance, demonstrating that HNBGI will provide insurance for those who finance a motorbike through Softlogic Finance. Present at the event were, Managing Director/CEO of HNBA and HNBGI, Mr. Deepthi Lokuarachchi and CEO of Softlogic Finance, Mr. Nalin Wijekoon.

Sharing his thoughts about the initiative, Mr. Lokuarachchi stated, “this is a fine partnership, executed upon consideration of responsiveness to the impact of increasing household incomes, as people are increasingly capable of purchasing a vehicle despite the so-called division of social-classes. Drawn out of such, it is clear that motorcyclists being a notable majority of this country, projects a great tendancy to increase over the years to come. Thus, it is of major importance that their safety is assured, which in turn will take its effect spanning across many motor related activities and involvements that are to be conducted safe and sound. This is when, and why, HNBGI will take on a vital role as to instill safety, especially of one’s mode of commute, while this partnership will take on the added essence of Softlogic Finance’s quality business perspective”.

Speaking on such, Mr. Wijekoon shared his views stating, “while expressing my heartiest gratitude towards HNBGI for joining hands with us, I take this moment to place admiration upon the contrast in ways of driving business, which Softlogic Finance has perfectly maneuvered, that is by adopting aspects such as quality and networking while also placing strong emphasis on an ethical facet made evident by this partnership. As of today and on this note, we are knowingly a helping hand for the ever common idiom, ‘dream vehicle’, and even for those who start small, we have provided a tangibilized, quality service without a doubt. I am thankful for all those who have contributed and provided assistance in achieving such a milestone in our road to sustainable business partnerships”.

HNBGI, which commenced business in January, 2015, specializing in motor and non-motor insurance solutions, is presently one of the fastest growing General Insurance Companies in Sri Lanka, with a network of 56 branches. HNBA, the Parent Company specializing in Life Insurance solutions is ranked within the Top 100 Brands and Top 100 Companies in Sri Lanka and has won multiple accolades for Brand Excellence, Digital Marketing and HR Excellence and many awards for its Annual Reports at award ceremonies organized by the Institute of Chartered Accountants of Sri Lanka and the South Asian Federation of Accountants.

Jul

HNB General Insurance Limited (HNBGI), the fully owned subsidiary of HNB Assurance PLC (HNBA) excels in providing a wide array of motor and non-motor insurance solutions. With its growing product portfolio and customer base, the Company has embarked on a mission to expand its operations across the country. The Company has adapted a well-focused customer-centric approach with the aim of providing an effective, superlative service to its customers.

Sharing his views on the Company’s outlook, Mr. Deepthi Lokuarachchi, Managing Director/CEO of HNBA and HNBGI stated “the general insurance market in Sri Lanka is a highly competitive market. In addition to the fierce competition and a myriad of challenges in the market, the prevailing adverse economic conditions make the market even more challenging for its players. The general insurance market as a whole has taken a stern turn with the increase in the use of vehicles and taxation imposed on vehicles. In addition to these factors, natural catastrophes such as extreme weather conditions, back to back floods have taken a hit on the industry. Due to these extreme conditions, most companies have adapted sustainable business strategies to compete in the market”.

Speaking on the product portfolio of HNBGI, Mr. Lokuarachchi added, “the success of any business within this discipline depends on the steadiness of its distribution channel, competencies of the agents and the nature its products. Over the years HNBGI has showcased an impressive growth, despite adverse market and economic conditions and has introduced a range of diversified products. While motor insurance remains the largest segment of the general insurance market, it comprises of other key segments such as travel insurance, marine insurance, fire insurance, home insurance and HNBGI caters to all these general insurance segments with a range of innovate products. The Company has also taken a step ahead in building tie-ups with a number of other brands and strengthening its Bancassurance channel in order to offer both motor and non-motor insurance solutions with a range of benefits”. Speaking further, Mr. Lokuarachchi added “the Company’s customer centric approach and improved efficiencies in claims settlement, set new benchmarks within the industry and helps in providing a superlative service to our customers”.

HNBGI, which commenced business in January, 2015, specializing in motor and non-motor insurance solutions, is presently one of the fastest growing General Insurance Companies in Sri Lanka, with a network of 56 branches. HNBA, the Parent Company specializing in Life Insurance solutions is ranked within the Top 100 Brands and Top 100 Companies in Sri Lanka and has won multiple accolades for Brand Excellence, Digital Marketing and HR Excellence and many awards for its Annual Reports at award ceremonies organized by the Institute of Chartered Accountants of Sri Lanka and the South Asian Federation of Accountants.